Accounting

Full service accounting in its true form - and everything in between. We can become your entire back-office accounting team of CPA, Controller, CFO, bookkeeping, and payroll.

Legal

Your business legal needs will finally be a breeze! They will be planned with your CPA, no longer requiring you to be the middle man.

0

Bumps

0

Offered

0

Drank

0

Saved

The WHAT and WHY of us...

Use our 30+ years of experience for monthly or quarterly coaching sessions to review business practices and the financial health of your company. So many great business people know their industry very well and are very talented in that area. However very few also have diverse skills and knowledge within the finance and accounting field. Which as we all know is the backbone of a business. Running a business without an in-depth knowledge of your financial situation is like stressing over the bug on your windshield while ignoring the smoke coming out of your engine. We work with the owner in a role similar to that of a CFO because most businesses cannot afford and do not need a in-house, full time CFO.

Don’t fall victim to the IRS. Take a proactive approach, planned and managed throughout the year to maximize the money in your pocket. Taxes are a necessary evil that must be addressed. However, contrary to popular belief, in business there are many things that can be done to manage tax. The most critical component to that management is that it’s done throughout the year, before year end, with long term goals in mind. Our tax planning sessions are completed in October and November giving you, if need, time to make critical business strategy moves. The vast majority of people believe that taxes are managed when their tax return is prepared. This is not true. The best time to manage tax is during the year and before year end.

Accurate, timely financial information is critical to a business. Bookkeepers enter the information but lack the ability to make it useful. We become your entire backroom, eliminating the need, headache and expense of hiring. Accounting systems designed and properly implemented have the power to transform an owners decision making ability.

Freedom to do what you do best. Spend time in the areas of your business that you enjoy and make you money. Entrepreneurs envision doing what they love all day long, but instead end up trying to fix QuickBooks and stressing over their billings. Business owners are where they are because they leverage a skill or a passion they have and make it attractive to others. Because of who they are, they are natural problem solvers trying to tackle every task that needs tackling. Focus on your strengths and find someone whose strengths are your weaknesses. You will never be happier or more profitable.

Our in-house attorney is ready to assist you with all your legal needs from contract review to liability assessments to various H.R. compliance needs. Just have a quick question, talk with your attorney for no hourly fees. Finally, get that estate plan in place you have talked about doing for years.

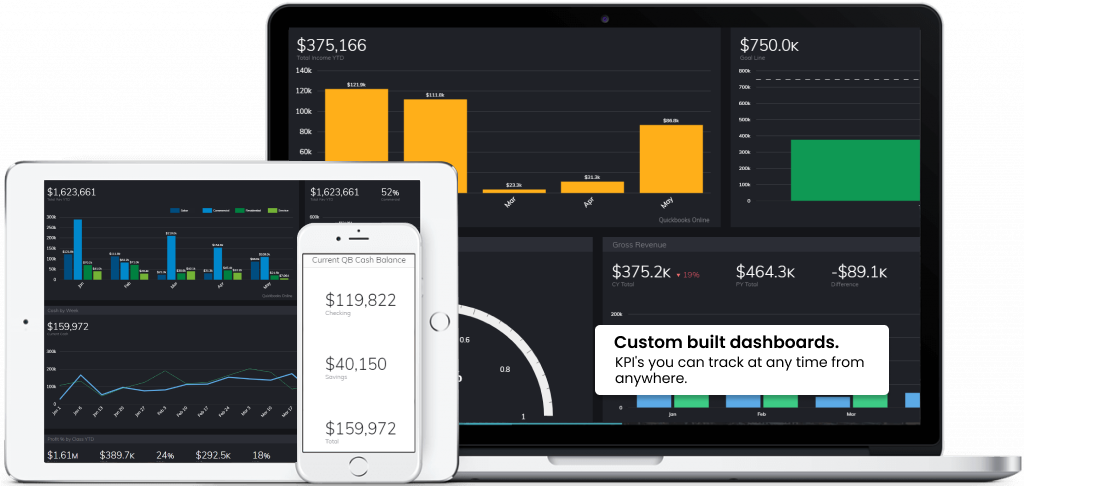

We’re closer than down the street, we’re at your fingertips. Distance is not an issue when we’re your partner. Thanks to technology we are in contact with you significantly more than you were with the guy around the corner that you used before. Zoom meetings and in-person contacts are the norm around here.

Real Business Consulting Resources

We provide you with all of your back office bookkeeping, accounting functions & processes, real time consulting and planning needs.

we bring more to the table

A board of professionals for your business

Advisor Table

Starting

Advisor Plus Table

Starting

Director Table

Starting

Executive Table

Starting

Booster Seats

SERVICE

STARTING

$165/month

$85/month

$75/month

$500/ea.

$750/ea.

$625/ea.

CFO/Controller Services

Legal Services

Financial Planning Services

Hospitality Consulting/Mgmnt

We bring more to the table

A board of professionals for your business

Ridiculously

Happy Customers

Knowing is half the battle

Skip to content

Skip to content